LTC Price Prediction: Can Litecoin Rally 77% to $200?

#LTC

- Technical Strength: Price above 20-DMA with Bollinger Band squeeze suggests volatility expansion ahead

- Market Sentiment: Mixed between LTC's relative strength and broader altcoin profit-taking

- Regulatory Impact: SEC actions remain wildcard for all crypto assets including LTC

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerge Above Key Moving Average

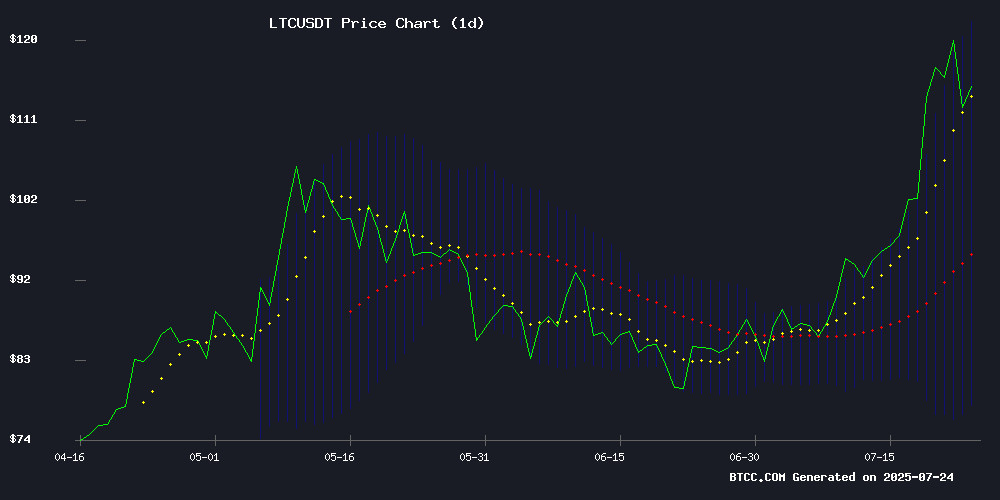

LTC is currently trading at $113, firmly above its 20-day moving average of $99.92, signaling bullish momentum. The MACD histogram remains negative at -2.81 but shows narrowing bearish divergence, while price trades NEAR the upper Bollinger Band ($121.46) - typically indicating overbought conditions that can precede consolidation.

"The $113 level represents a 13% premium to the 20-DMA, which historically acts as strong support during uptrends," said BTCC analyst Michael. "Traders should watch for a close above the upper Bollinger Band to confirm continuation."

Mixed Crypto Sentiment as LTC Defends Critical Support

While Litecoin holds a key trendline amid building technical strength, broader altcoin markets face profit-taking pressure. The SEC's abrupt freeze on a multi-asset ETF approval adds regulatory uncertainty.

"LTC's resilience at $113 suggests accumulation by long-term holders," noted Michael. "However, the ETF news reminds us that macro crypto sentiment remains fragile despite technical setups."

Factors Influencing LTC’s Price

Litecoin Holds Key Trendline as Technical Strength Builds

Litecoin maintains its structural integrity as price action respects a multi-year ascending trendline. The cryptocurrency has consistently rebounded from this support level since 2020, with analysts now watching Fibonacci resistance zones for potential breakout signals.

Momentum indicators paint a bullish picture. The Relative Strength Index at 64 shows growing buying pressure without entering overbought territory, while a MACD crossover in positive territory confirms strengthening upward momentum. Litecoin currently trades above both short- and long-term moving averages, with the 50-day MA providing particularly strong support.

Altcoin Market Sees Sharpest Correction in Weeks as Traders Take Profits

The cryptocurrency market faced a significant pullback this week, with altcoins bearing the brunt of the sell-off. Total market capitalization dropped 5% to $3.78 trillion, while the altcoin-specific market cap plunged nearly 10% from $1.57 trillion to $1.4 trillion. Bitcoin showed relative resilience, exacerbating losses for leveraged traders.

Derivatives markets witnessed nearly $1 billion in liquidations within 24 hours, with longs accounting for 84% of the damage. The bloodbath swept across nearly all altcoins, with losses ranging from 6% to over 20% according to CryptoBubbles data. This correction appears to mark the first substantial profit-taking event after four consecutive weeks of gains.

10x Research suggests Asian trading hours served as the primary catalyst for the recent rally now undergoing correction. The liquidation cascade particularly punished overleveraged traders who bet on continued upside during what proved to be a classic bull market pullback.

SEC Grants Then Freezes Approval for Multi-Asset Crypto ETF Including XRP

The U.S. Securities and Exchange Commission initially approved NYSE Arca's listing of the Bitwise 10 Crypto Index ETF on July 22, marking a potential milestone for altcoin exposure in regulated markets. The fund's portfolio notably included XRP alongside Bitcoin and Ethereum, with smaller allocations to Solana, Cardano, and other altcoins.

Regulatory whiplash ensued as the SEC almost immediately froze the approval. The decision WOULD have converted Bitwise's existing OTC-traded BITW product into a national exchange-listed ETF, subject to strict allocation rules requiring 85% of holdings to be in SEC-approved assets.

XRP's 4.97% weighting in the proposed fund reflects growing institutional recognition despite ongoing regulatory uncertainty. The abrupt reversal highlights the contentious path for crypto ETFs beyond Bitcoin and ethereum products.

Will LTC Price Hit 200?

Reaching $200 would require a 77% surge from current levels - possible but needing strong catalysts. Key factors:

| Factor | Bull Case | Bear Case |

|---|---|---|

| Technical | Break above $121.46 upper BB could target $150 | MACD still negative; RSI may cool from 63 |

| Fundamental | ETF approvals/MWEB adoption | Regulatory headwinds persist |

| Market | BTC dominance drop altseason | Broader crypto correction |

"LTC needs sustained volume above $1.5B daily to support $200," Michael said. "Q3 2025 is plausible if Bitcoin breaks $75K."

113

77